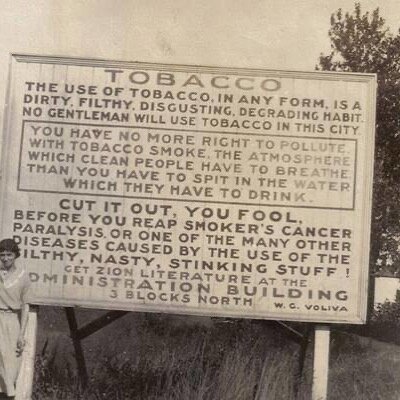

In 1970, when we at Harmony Foods were importing miso, tamari, seaweed and soba from Japan, we had a problem. Every shipment was blocked by the port health authorities in the UK because they came from Japan. Samples were taken away for analysis to see what prohibited colourings, preservatives and flavourings were present that would bar them from entry. Our products never failed these tests as they were from traditional Japanese producers who were the last holdouts against the industrialisation and chemicalisation of the Japanese food supply.

In 1971 a group of obstetricians and dietitians called for an urgent meeting with the Japanese health ministry. They expressed the concern, if something wasn’t done about the dreadful food the Japanese were eating, that by the year 2000 there wouldn’t be a single baby born in Japan that didn’t have some birth defect caused by the stuff their mothers had been eating. The reaction was swift and firm: dodgy ingredients were phased out overnight and Japan moved to the world’s cleanest standards of food processing. In the 1980s, when we were exporting Whole Earth jams to Japan the boot was on the other foot: every shipment from the UK was delayed by zealous Japanese port health authorities checking every product to make sure it didn’t contain additives that were banned in Japan. It’s not racism to value your heritage and to do whatever is necessary to ensure that DNA that has evolved and been refined by your ancestors over generations isn’t screwed up by food processors trying to add a penny or two to their margins.

In the US, which has been the slowest to remove additives and hydrogenated fat from the food supply, there has been an unexpected bonus for pension funds: people aren’t living as long as the actuaries expected which means there is a lot of money that is budgeted for paying out pensions that will never be spent. It is going back to shareholders as increased dividends. The same thing is happening in the UK. Life expectancy increase has stalled here, too.

What’s going on? There are 2 separate trends: there is the fitness and healthy eating trend - these people have dramatically increased their longevity expectations. Then there is the junk food/sugar/diabetes/heart disease trend, these people are dying sooner. Medical advances are helping keep people alive who would have died of those conditions a few decades ago, but this masks a real decline in quality of life for those who survive. The proliferation of mobility scooters tells a story: people who have simply eaten far too much food and probably drunk too much booze are finding it impossible to carry their weight on knees and ankles that were designed to carry far lighter loads. It doesn’t help that phosphoric acid, the preservative used in almost every cola drink, also reduces bone calcium, making it even harder for increasingly brittle bones to support all that excess weight.

The danger is that we will become victims of our own success. The natural products industry is the main driver of this movement towards healthier eating, more exercise and better available food choices. The actuaries at those pension funds are in danger of making the same mistake again, but the other way around. Instead of over providing for pension payments and finding themselves with too much dosh in the kitty, they could end up following the statistics and assuming that life expectancy has stalled or is in decline. They’ll pay the money out to their shareholders, then discover to their horror that those pesky healthy pensioners are living much longer and becoming a drain on the pension fund’s resources.

Healthy people are paying too much for life insurance and unhealthy people are paying too much for their pensions. Time for a 2-tier system?

One insurer, Vitality, are now offering lower rates for life and health insurance for policyholders who share the information from their fitness devices. If they walk 12,500 steps a day, follow a healthy diet or work out at the gym they get discounts. All they have to do is connect their Fitbit or their Apple Health monitor to the insurer’s link and they get paid for looking after their health. Prevention pays.