Would you pay more in order to have glyphosate residues in your pint?

Putting a price on carbon makes people pay for carbon dioxide that they add to the atmosphere (ouch!) and rewards behaviour that reduces atmospheric carbon dioxide (yes, please).

So why not just make people who emit carbon pay for that carbon dioxide and give the same amount of money, the ‘carbon price’, to people who take it out of the atmosphere?

A lot of people make money out of carbon emissions. Oil companies are the main subjects of hatred, but it is the rest of us who actually burn the fossil fuels that keep our homes warm, our cars on the road and planes in the air. The biggest beneficiary is the Government, which gets 53p per litre of petrol, plus another 10p of VAT. It’s like the situation with cigarettes: the Government knew for decades that fags were killing people but the tax per packet was a vitally important source of income, so it was challenging for the powers-that-be to crack down on smoking. Even palm oil, most of which gets mixed with diesel fuel, gets taxed at 53p per litre, but the food industry takes the flak when it’s in a biscuit. Palm oil has replaced hydrogenated fat, which is why heart disease rates are falling.

Organic versus non-organic

Organic farmers increase soil carbon every year: they compost green waste and crop residues; they add manure to the soils instead of chemical fertilizer; they do crop rotations that naturally boost soil nitrogen; they encourage a resilient soil microbiome that also increases soil carbon; they let the land go fallow so natural fertility is rebuilt, which means more soil carbon. An organic farm can capture and store about seven tonnes of carbon dioxide per hectare per year.

Non-organic farmers use chemical fertilizers that wipe out the soil micobiome and cause nitrous oxide pollution that is a much worse greenhouse gas than carbon dioxide. Intensive animal rearing of cattle and pigs leads to higher methane emissions, another potent greenhouse gas. Herbicides and pesticides are made from fossil fuels and end up as more global warming. Farming is responsible for one third of our annual increase in greenhouse gas levels. Organic farming could cancel out that increase and bring greenhouse gas levels down by a similar amount and we could stop stressing about climate change.

Powerful stuff

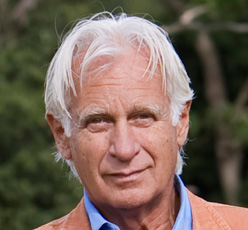

So how can we encourage organic farming? How do you encourage anything? Money. Powerful stuff. Farmers love it.

The EU carbon price is just over £90 per tonne of CO2. An organic farmer can capture at least seven tonnes. If they got paid for it, that would be an extra income of £630 per hectare.

A non-organic farmer emits at least two tonnes of CO2 per hectare per year from fertilizer and soil organic matter breakdown. If they had to pay for that (a tax on fertilizers and pesticides) it would cost them at least £180 per hectare.

Every crop is different, but let’s take a look at barley. Let’s say that a barley farmer - whether organic or not - wants to make £1630 per hectare.

An organic farmer gets four tonnes of barley per hectare and can sell it at £250 per tonne; that’s £1000 per hectare. With a CO2 payment of £700 per hectare that adds up to £1700 per hectare gross income. Bingo!

A non-organic farmer gets a higher yield (thanks to chemicals) of six tonnes per hectare. At £250 per tonne that generates £1500 per hectare gross income. But the farmer must pay for two tonnes of CO2 emissions - £180 - so that brings it down to £1320. So to make as much as the organic farmer, the non-organic farmer would have to charge £305 per tonne for barley, an extra £55 per tonne. What brewer will pay a £55 a tonne premium for non-organic barley?

Much barley ends up in beer. If you’re down the pub and a pint of organic bitter is £3.30 and a pint of non-organic is £3.90 would you be prepared to pay more in order to have glyphosate residues in your pint?